Financial Management Software For Mac

Personal finance software can help you to manage your money flow in a better way. Money management is the most critical task in both personal and business life. For helping the business owners and personal finance management, there are many finance software is available for Mac. The budgeting apps are smart enough to send notifications to any unusual bank and credit card activity in real time. In addition to this, these finance managing software tools can notify you of any interest charged on credit cards and bank accounts. There are free personal finance software apps and premium budget software for finance management. Free budgeting software is also good enough to record and summarize your cash flow and help to manage your personal or business budget in every month.

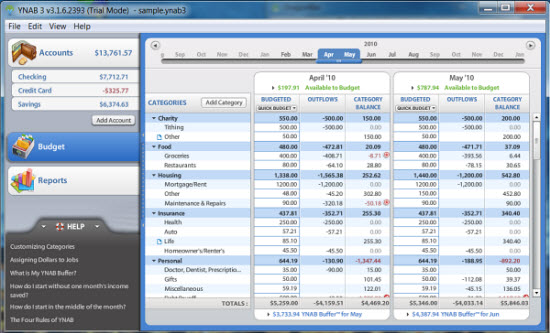

Here is a list of best personal finance software for Mac to get the centralization and overview of spending habits. Banktivity 5 Banktivity formerly known as iBank 5, is one of the best personal finance software for mac in Apple Store. YBanktivity finance management software is the best choice for those who want to track transactions and manage the personal finance, that is better than simple accounting software. This Mac budget software can connect more banks and credit card accounts than other free software.

The Banktivity Mac app can get enhanced investment support for bonds and offers dismissal of similar transactions from the bank data downloads. You can acknowledge your mistakes by comparing the past, current or projected projects.

Through Banktivity cloud sync, you can sync your banktivity files on more than one device for free to get access to them whenever you want to. The app effortless manages your transactions, allowing control over the budgets, stock portfolios, etc.

Download: 2. MoneyWiz 2 – Personal Finance MoneyWiz 2 allows you to efficiently control all your financial transactions, making this budget software a top choice among all the personal finance software for Mac. This finance software allows you to import the data from other apps and ensures a smooth run due to its sleek and sturdy interface. MoneyWiz automatically monitors your financial transactions and assigns them in the needed budgets and build custom reports based what you acknowledge regarding your money. MoneyWiz 2 budget software is there to assist in online banking, downloading all your transactions and you can use any file on it from CSV, QIF, OFX, QFX to MT940 file.

Related: Make your transaction entry to be fast with the software. The finance software is helpful in budget tracking and protects your data with a PIN which can be set for a particular time period. The PIN will auto-erase on 10 wrong attempts for maximum security and comfort. Download: 3. Debit & Credit – Personal Finance Manager Looking for a personal finance software, that offers convenience and at the same time has the needed features, then Debit & Credit software is the right choice for you.

With this budget software, you can easily reconcile your accounts with the bank statements for eliminating any disparities and getting the extra help to keep the accounts in shape. Create a new transaction in a matter of seconds and save the locations of the places where you go often, helping you to record the expenses easily. Get clean and crisp reports along with Split categories, pending transactions, transaction export, file attachments (with sync), transaction tags. Debit & Credit Mac software comes in eight color themes available for selection in the settings of the software allowing you to customize your experience. Related: Download: 4.

Moneydance 2015 Moneydance is one of the best personal finance software for Mac handling multiple currencies and doing any financial task virtually with ease. This Mac Budget Software has more reporting options than the majority of other software inherits; giving you centralized access to all the data related to your financial transactions.

Follow your investments and focus more on your portfolio through the software. Never miss a payment by scheduling for single or recurring transactions.

Send online payments quickly and attach images, PDFs, and other such files to transactions. It learns how to categorize the downloaded transactions automatically. Create and control your budget like a breeze also ensures the inflow as well as the outflow of money through Moneydance.

Ms Finance Standing out from the crowd, Ms Finance is there to solve all the troubles encountered with the previous personal finance software. The app makes the tracking and paying off bills convenient by bringing them at a single place. It handles multiple accounts with the support for the transfers between same currency accounts. Create custom reports to show any financial data virtually through the report assistant. Forecast your financial requirements for the future through Ms Finance. Get accurate statements regarding the balances of your account to get the needed help.

The developers of the software have tried to make the design and user interface to be intrusive and simple as possible to allow the user to access the features easily. Quicken 2 Quicken is well known for financial management and offer iPad and Mac software. This Finance Management Software can import all your bank transactions safely & automatically. This excellent software can automatically categorize your spending. The additional features like portfolio performance, make informed buy/sell decisions and find funds that fit your goals are nice features to make this one of the best finance software. Quicken automatically generates bill reminders and pay your bills with Quicken Bill Pay and offer investment tracking, offline use & enhanced search Download: 7. IFinance 4 iFinance is a personal finance software inheriting some great features, making it worth a try. You can easily compare your investments to the rest of the market.

Mac Money Management Software

It is a good program that can easily handle the transactions of varying forms. The Mac finance software analyzes your finances and maintains its records through Cloud Sync or Wi-Fi.

It gives the users easy to customize charts as well as reports; iFinance 4 clearly arranges the transaction lists of all your financial resources, group different types of expenses. Download: Know how the assets perform with the reports made by the tool. IFinance offers the user a broad range of easy to customize charts and reports giving you the precise reports on the source of money and the spending without any trouble. Best financial software must have the capability to securely connect all your bank accounts and credit cards in one place. This software can track your income and expense in real-time and advice to manage the budget and invest the money in diverse ways in the coming future. In addition to this, these financial software tools summarize all your monthly expenses and automatically set budget for each category to limit your spending. Related: Through with these personal finance software for Mac, you can track your expenses and the balances of your account for the best management of money and credit cards.

Business Management Software For Mac

With efficient management of money, you can get early warnings regarding the upcoming financial fines, interest payments, and bills.

A few years back a world without as the mainstay of personal finance apps would have been unimaginable. It was the go to application for managing personal finances on your Mac.

Now it’s hard to imagine that world without IGG Software’s. IBank 5 is a best of class app that continues to add features and value and which should be your personal finance app of choice. How easy is it to get iBank 5 up and running and so you can start tracking your current financial status?

Let’s put it this way; I had 11 bank accounts and an investment account set up and all transactions imported in less time than it took to boil a pot of coffee water and steep a press pot. This is in large part because of an an optional IGG Software subscription service called ($5 per month, $13 per quarter, or $40 per year), which connects directly to your banking institutions using your authentication information and downloads transactions directly into iBank 5. If you prefer a more traditional method or prefer not to have an app access your banking data, iBank also offers options for manually entering your banking data or importing the Quicken or Microsoft Money files you can download from your bank.

IBank also offers tools for easily migrating your data from other financial management tools such as Microsoft Money and Quicken. IBank 5 offers quick and comprehensive access to all your financial information. Once your data is imported you do have to go about the business of matching your transaction data to expense categories. Fortunately iBank is a pretty quick study, capable of matching future transactions from the same vendors to the categories you originally mapped them to. If the default set of categories the app provides don’t suit your needs or are not as expansive as you need them to be, the Categories tool appearing in iBank’s library list lets you make quick work of adding, removing or updating categories.

IBank 5 organizes your banking data in a way that makes it easy for you to quickly assess your current balances. A Library list at the left of the app’s main window shows a list of your accounts, provides a basic set of reports, and tools for creating budgets. Items within iBank 5’s groupings can be dragged and reorganized in a way that makes sense to you. If you prefer an uncluttered look, any of the items appearing in the Library list can be hidden or revealed with the click of a button.

A summary displaying how much money you have and how much you owe appears at the bottom of the list. You have the option of selecting the accounts that are included in this summary. So, for example, if you share an account with someone but don’t want the money in that account to be included in your total net worth, you can easily exclude it.

Transactions appear in a ledger to the right of the Library list. Each transaction that appears in the list and for which you’ve supplied a category displays a small image representing the type of transaction you’re looking at. So a grocery purchase has a small grocery basket next to it and a gasoline purchase has an image of a fuel dispenser next to it. These images can be customized to your liking, but the reality is that they offer little in the way of real value. They’re just a kitschy addition to the app. IBank 5 ships with several standard reports each of which gives a graphical overview of where you’ve spent your money. The app’s basic offering include income and expense reports for the last month, last year, and current year as well as a net worth report.

The app’s existing reports can be customized to suit your specific needs or you can create your own reports by choosing the Add New Report option from the Tools menu. IBank 5 provides 10 starting points for reports, including Portfolio Summary, Category Detail, and Forecast reports. Once selected these accounts can be customized to include specific accounts and categories. The app’s budgeting tools offer both the traditional budgeting method of making “guesstimates” of how much you hope to spend each month and comparing your actual estimate to that budgeted amount or the truly old-school method of envelope budgeting, which pre-allocates funds to specific budget categories from which you can then “draw” funds for payment in those categories. IBank 5’s budgeting tool walks you through a brief questionnaire about scheduled and unscheduled transactions, how much income you expect to see each month and where you expect to spend your money. I found the budgeting tools to be excellent and, if you choose to use the envelope method, simple, when necessary, to pull money from one envelope so you can put it another. IBank offers a number of ways to make it easy to stay on top of your bills and to get them paid.

Scheduled transactions automatically appear in the Calendar app. If your bank account is setup to use bill pay features you can use iBank 5 to pay your bills, with the added benefit that iBank 5 will first check to make sure that the transaction will not cause an overdraft. Bottom line iBank 5 is an excellent personal finance application that makes it effortless to track your financial transactions, stock portfolios, as well as create budgets and reports to help you assess your current and future financial status. There is no better financial app available today for your Mac.

Comments are closed.